52 Week Money Challenge – A Simple Way to Save Money

Saving, paying off debt, paying bills, this is my current situation. Even with working down to pay down my debt and paying bills, I still look for simple and easy ways to save money even if it’s just a little bit. Every little bit counts, right!

For this reason, I am trying the 52 Week Money Challenge as way a to save money. Admittedly, this will require a change in mindset. Financial Advisors say that although you have bills to pay and are working to pay down debt, you should pay yourself first. I like most people do it the other way around.

Yes, that’s right, you must pay yourself first, even if it’s a small amount which is why the 52 Week Money Challenge appeals to me.

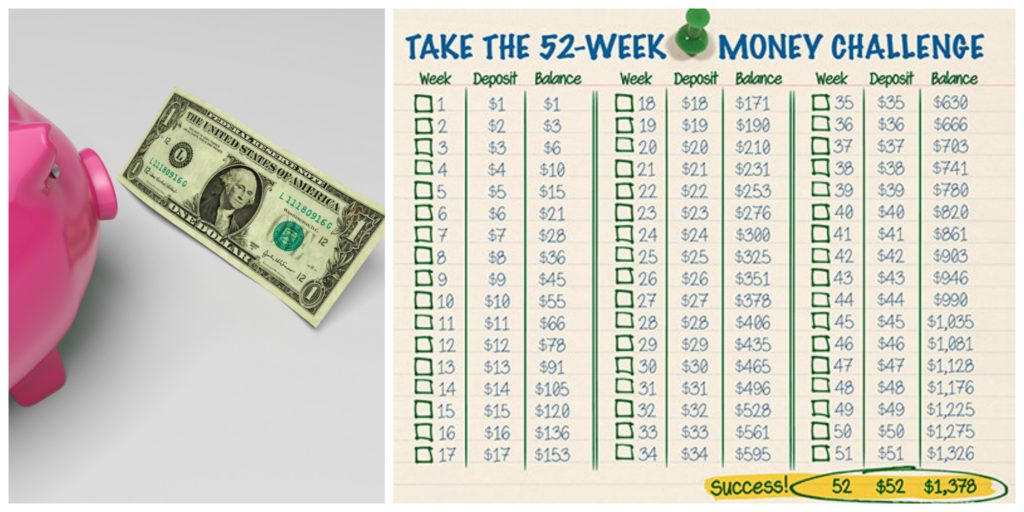

It’s a pretty simple concept really which I think is actually doable and at the end of the 52 weeks, you will have actually saved a chunk of change. $1,378 to be exact.

So how does the 52 Week Money Challenge work?

In a nutshell, in week 1, you deposit $1 in your bank account and build up to depositing $52 in the last week of the year. I don’t know about you but I am pretty sure I can find $4 or $5 or whatever to deposit in my account each week. The last month might be tougher but by then you will have most likely omitted something from your budget to find $52 to save. It’s been suggested to work backwards but I am going to try to start from $1.

Just imagine at the end of the year, you will have saved $1,378 that you can either spend on Christmas gifts, a vacation, pay down a debt or keep on saving. I am planning to actually deposit the money into my daughter’s savings account for her college fund.

You can either download a 52 Week Challenge document to track or if you are like me, I keep track of my savings along with my daily expenses in my journal.

Do you have an easy tip to save money? Let us know.

Disclosure: NYC Single Mom was not compensated for this post. I just need to save some money.